Washington yawns as interest payments surpass military spending

In Greek mythology, the princess Cassandra warned her fellow Trojans that the wooden horse outside the gate of Troy was packed with Greek warriors. No one believed her. The Trojans brought the horse into the city. Catastrophe ensued.

The federal government’s ballooning debt has had many Cassandras. For years they’ve been predicting that the debt’s continued growth will lead to disaster. Apparently, no one in Washington believes them.

Congress keeps passing deficit budgets that add to the debt. It doesn’t matter which party controls Congress; both yawn when the Cassandras issue their warnings.

In the just-ended fiscal year, the federal government – Republicans in control of the House, Democrats the Senate – spent $1.83 trillion more than it took in. That brought Uncle Sam’s cumulative debt to around $35 trillion.

If the nation had a gross domestic product in the neighborhood of $75 trillion, or even $50 trillion, the lips of the Debt Cassandras would be sealed. An economy that size would generate more than enough taxes for the government to make its interest payments and maybe even pay down the principal.

Alas, the US GDP is only $25 trillion.

Many experts say a government-debt-to-GDP ratio above 60% begins to raise red flags. Others say 77%. Uncle Sam’s ratio is above 130%. Even excluding debt that one part of the government owes another – in other words, just counting debt held by the public – the ratio is almost 100%.

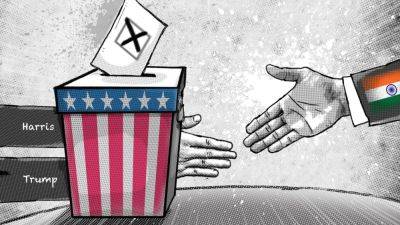

Debt held by the public is projected to rise under current law to 125% by 2034. The nonpartisan Committee for a Responsible Federal Budget projects that it would rise to 133% of GDP by 2034 if Kamala Harris is elected and to 142% if Donald Trump wins.

Put aside the difference between the two; there’s