Paul Tudor Jones says market reckoning on spending is coming after election: 'We are going to be broke'

Billionaire hedge fund manager Paul Tudor Jones is raising alarms about the U.S. government's current fiscal deficit and the increased spending promised by both presidential candidates, saying the bond market may force the government's hand after the election in addressing it.

"We are going to be broke really quickly unless we get serious about dealing with our spending issues," Jones told CNBC's Andrew Ross Sorkin on Tuesday.

The founder and chief investment officer of Tudor Investment said he was worried that government spending could cause a big sell-off in the bond market, spiking interest rates. He said he plans to not own fixed income and will be betting against the longer-dated part of the bond market.

"The question is after this election will we have a Minsky moment here in the United States and U.S. debt markets?" Jones said, referring to shorthand for a dramatic decline in asset prices.

"Will we have a Minsky moment where all of a sudden there's a point of recognition that what they're talking about is fiscally impossible, financially impossible?" he continued.

The federal deficit for the 2024 fiscal year soared above $1.8 trillion, according to the Treasury Department, 8% higher than 2023.

The government offsets this deficit by selling Treasury bonds, and the time profile of the bonds and the cadence of the sales are closely watched by Wall Street traders. The increase in interest rates over the past three years is another concern for many economists and traders, as it makes the annual cost of the debt higher for the government.

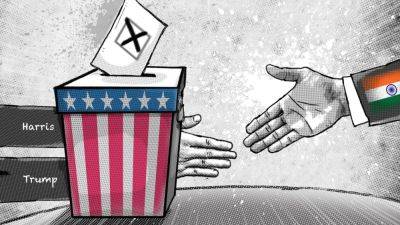

Jones pointed out in the interview that budget deficits increased under the administrations of former President Donald Trump and President Joe Biden, and said that Trump and Vice President