Oil markets not pricing in an 'all-out war' after Israel kills Hezbollah leader, but risks persist

Oil prices didn't react sharply on Monday after Hezbollah confirmed that its leader was killed on Friday in an Israeli airstrike in the Lebanese capital of Beirut.

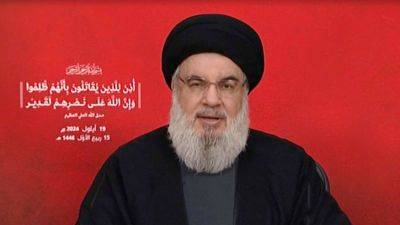

Over the weekend, Israel Defense Forces reported that Hassan Nasrallah, who had led the Iran-backed militant group Hezbollah for over thirty years, was killed on Friday during a "targeted strike" on the group's headquarters in Beirut.

Hezbollah, classified as a terrorist organization by several countries including the U.S. and the UK, is known for its violent opposition to Israel and its resistance to Western influence in the Middle East, according to the U.S. Director of National Intelligence and London Assembly.

The incident follows several months of conflict and had raised concerns of a wider conflict involving Iran. The IDF characterized Nasrallah as the group's "central decision-maker" and "strategic leader."

But oil markets did not see a significant surge. Global benchmark Brent added 1.56% to $73.10 a barrel, while U.S. West Texas Intermediate futures traded 1.09% higher at $68.19 per barrel.

While hostilities throughout the Middle East have ramped up, there has not been any oil supply disruption, observed Andy Lipow, president at Lipow Oil Associates.

"The oil market does not expect an all-out war between Iran and Israel that would impact supply," he told CNBC via email.

Since Hamas-Israel conflict that started last year, the disruption to the oil market has been limited. The oil market also remains under pressure as increased production from the U.S. Canada and Guyana add to the supply picture, on top of stalling Chinese demand while OPEC+ delayed the restoration of their production cuts, Lipow elaborated.

"The elimination of Hezbollah leadership could