A supersized Fed rate cut this month could be 'very dangerous' for markets, economist warns

A deeper interest rate cut from the Federal Reserve this month could spook financial markets and send the wrong message about an imminent risk of recession, according to one economist.

It comes as policymakers at the U.S. central bank are widely expected to start lowering interest rates when they meet on Sept. 17-18, with investors closely monitoring economic data for clues on just how big a rate cut they are likely to deliver.

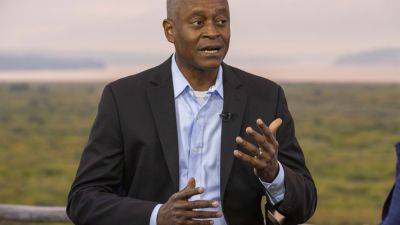

George Lagarias, chief economist at Forvis Mazars, told CNBC on Thursday that while no one can guarantee the scale of the Fed's rate cut at its forthcoming meeting, he is "firmly" in the camp calling for a quarter-point reduction.

"I don't see the urgency for the 50 [basis point] cut," Lagarias said.

"The 50 [basis point] cut might send a wrong message to markets and the economy. It might send a message of urgency and, you know, that could be a self-fulfilling prophecy," he continued.

"So, it would be very dangerous if they went there without a specific reason. Unless you have an event, something that troubles markets, there is no reason for panic."

The Fed's benchmark borrowing rate, which influences a bulk of other rates that consumers pay, is currently targeted in a range between 5.25%-5.5%.

Atlanta Federal Reserve President Raphael Bostic on Wednesday signaled his readiness for the central bank to start lowering interest rates. His comments came ahead of what is expected to be a highly influential nonfarm payrolls report on Friday.

Strategists have typically said the most likely outcome from the Fed's forthcoming meeting is a 25-basis point rate cut, although recent economic data appears to have strengthened the case for a bigger move.

Data published on Wednesday showed that U.S. job openings fell to