CNBC Daily Open: Can’t wait until 2% to start cutting rates

This report is from today's CNBC Daily Open, our international markets newsletter. CNBC Daily Open brings investors up to speed on everything they need to know, no matter where they are. Like what you see? You can subscribe here .

Second-day drop

On Wednesday, the S&P 500 and Nasdaq Composite fell for a second day, but the Dow Jones Industrial Average managed to buck the trend with a slight rise. The pan-European Stoxx 600 index closed around 1% lower, tracking losses on Wall Street and in Asia-Pacific markets. Technology stocks were the hardest hit, losing 3.2%.

A jolting number

Job openings in the U.S. fell to 7.67 million in July, 237,000 fewer than June's number, which was revised downwards. It's not only lower than the expected 8.1 million, it's also the lowest level since January 2021. Even though job data look weak, there are still around 1.1 open jobs per available worker.

Ready to lower rates

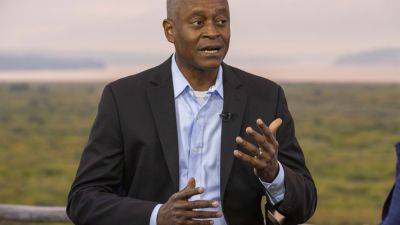

A 2% inflation reading has been the U.S. Federal Reserve's target, but it seems the central bank is now turning its attention to the jobs market. Atlanta Federal Reserve President Raphael Bostic – who is known to be hawkish, that is, in favor of higher rates – said he's ready to lower rates even though inflation's still slightly higher than 2%.

Inverted curve briefly reverted

When the 10-year Treasury yield is lower than the 2-year yield, we have an inverted yield curve, which has predicted most recessions since World War II. The current curve inverted in July 2022, but normalized briefly Wednesday. Don't get too comfortable, though: The curve usually reverts before a recession hits.

[PRO] Loud recession crowd

Analysts and market watchers have been anticipating a recession in the U.S. economy for years. It hasn't happened yet. In