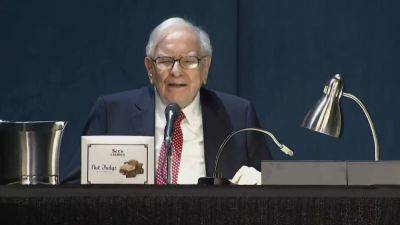

These Asian firms in Buffett's Berkshire Hathaway portfolio have surged, with one soaring 30%

The five trading firms in Warren Buffett-backed Berkshire Hathaway's portfolio — Itochu Corp, Marubeni Corp, Mitsubishi Corp, Mitsui & Co, and Sumitomo Corp — have surged, with one rising as much 30% in 2024.

These five names are also the biggest of Japan's so-called sogo-shosha, or general trading companies, in which Berkshire placed big bets in 2020 and subsequently increased stakes in later years.

Japan's trading houses, which trade in a wide range of products and materials, played a big role in Japan's economic growth.

And they are increasingly operating as global venture capital and private equity businesses – which, for Buffett, these diversified operations could be part of the draw.

Berkshire hit a $1 trillion market capitalization on Wednesday, the first non-technology company in the U.S. to hit the milestone.

As of Thursday morning, the company was worth $994.58 billion. Shares of the Omaha, Nebraska-based conglomerate has surged 30.3% in 2024, far above the S&P 500′s 17.24% gain.

Though it holds Japanese and Chinese equities, it mostly invests in American companies, with Apple, American Express, Bank of America Corp. and Coca-Cola Co forming the bulk of its portfolio.

Here are the Asian companies which Berkshire has invested in:

Mitsubishi Corp, Itochu Corp, Mitsui & Co, Marubeni Corp and Sumitomo Corp have seen their shares surge 33.3%, 29.8%, 14.6%, 9% and 10.9% in 2024, respectively, according to LSEG data.

Berkshire raised its stakes in these top five trading firms to around 9%, the firm said in its 2023 annual report, up from 6-7% in 2022.

"Berkshire continues to hold its passive and long-term interest in five very large Japanese companies, each of which operates in a highly-diversified manner somewhat similar to