Hints of a yuan versus yen currency war

TOKYO – The costs of a chronically weak yen just grew by US$18 trillion as China’s economy, Asia’s biggest, may be joining the race to the bottom.

It’s still unclear if the drop in the Chinese exchange rate that began Friday is the start of a trend that would surely rock global markets or just a fluke. But the correlation with the Japanese yen’s decline is hard to ignore.

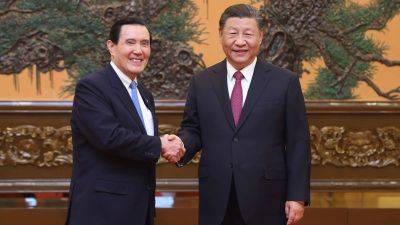

To be sure, President Xi Jinping’s team threw markets a lifeline on Monday. The People’s Bank of China signaled that the yuan might not be about to plunge with a slightly higher-than-expected daily reference rate of 7.0996 per dollar. That’s the biggest strengthening bias since November.

Even so, many analysts think the PBOC may be finally losing tolerance with Japan allowing the yen exchange rate to drop so far with little blowback in Washington – particularly as China struggles to keep economic growth as close to its 5% target as possible.

Chinese authorities don’t announce weaker-than-expected daily fixing levels in a vacuum. The decision on Friday to fix the yuan rate lower as the yen was sliding anew hardly seems a coincidence.

“After Friday’s fireworks with the PBOC nudging the yuan weaker, markets have run with it,” says Sean Callow, senior currency strategist at Westpac.

Are the beggar-thy-neighbor currency strategies of the past returning to China’s $18 trillion economy?

Economist Brad Setser, senior fellow at the Council on Foreign Relations, speaks for many when he observes that Friday’s hint still “leaves the ‘why now’ question unanswered.”

Only time will tell. Odds are, Xi and Premier Li Qiang would prefer to keep any weakening in the yuan orderly. Unleashing panic in currency circles – and in a US election year – hardly seems in Beijing’s