China looking like a ‘buy’ as US, Japan markets sag

As global investors dump US and Japanese stocks, China’s beaten-down markets are suddenly looking more attractive.

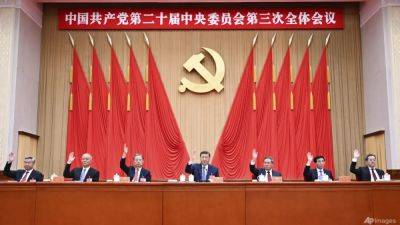

The debate over whether China is “uninvestable” has plagued Xi Jinping’s government since late 2020. That was back when Xi’s Communist Party cracked down on tech platforms, starting with Jack Ma’s Alibaba Group.

It hardly helped that Xi’s draconian Covid-19 lockdowns drove China’s growth into the red. Or that Xi’s party was slow to add fresh stimulus to Asia’s biggest economy when it arguably needed it most.

Now, China has a unique opportunity to shine as a bastion of stability as the US and Japanese economies face fast-mounting challenges.

US employment growth is slowing, spooking global punters who had grown used to the economy adding 200,000-plus new jobs per month. The US Federal Reserve, meanwhile, has been slow to cut interest rates as inflation has remained stubbornly close to 3%.

Adding to the drama is extreme political polarization at a moment when Americans prepare to pick a new president on November 5. This, against the backdrop of the US national debt topping US$35 trillion.

In Tokyo, markets are in abject trauma following the Bank of Japan’s July 31 rate hike. On Monday, the Nikkei Stock Average fell the most since “Black Monday” in 1987. Though stock prices later stabilized, fears of additional BOJ rate hikes have global investors on edge.

A big worry is the “yen-carry trade” blowing up. Since 1999, when the BOJ first cut rates to zero, investors everywhere have been borrowing cheaply in yen and using those funds to bet on higher-yielding assets around the globe.

This explains why sudden moves in the yen can savage asset markets in New York, London, Dubai, Seoul and Shanghai. And raise