China cuts key rate amid worst deflation since ’99

Pan Gongsheng isn’t famed for acrobatic skills. But on Monday (July 22), the People’s Bank of China governor embarked on a routine that will test his monetary balance, agility and motor coordination in tantalizing ways.

The PBOC’s move to cut a key short-term policy rate for the first time in almost a year surprised many traders. Lowering the seven-day reverse repo rate by 10 basis points to 1.7% was aimed at supporting Asia’s biggest economy after first-quarter economic growth disappointed. And odds are, it won’t be the last cut as China grapples with the worst deflation since 1999.

But the program Pan must execute is a precarious one as the PBOC struggles to keep the yuan from weakening. This has taken the form of officials establishing a floor for 10-year government bond yields at, or around, 2.25%. PBOC watchers generally agree Pan’s team sees that level as a red line for rates, particularly after it fell to a record 2.18% low earlier this month.

Juggling these dual challenges won’t be easy. On the one hand, China’s 4.7% year-on-year growth rate during the January-March period was a wake-up call for President Xi Jinping’s Communist Party. The details within that reading – including weak retail sales, lackluster industrial activity and anemic investment – show Xi’s efforts to date to stabilize a cratering property sector and revive consumer prices aren’t going as planned.

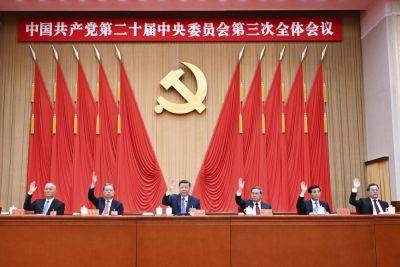

Deflationary forces, meanwhile, are raising other alarm bells. Particularly after last week’s much-awaited Third Plenum planning session ended without immediate signs that Beijing is necessarily shifting economic reform into higher gear.

As such, the PBOC rate cut is a “step in the right direction,” says economist Zhang Zhiwei, president of Pinpoint